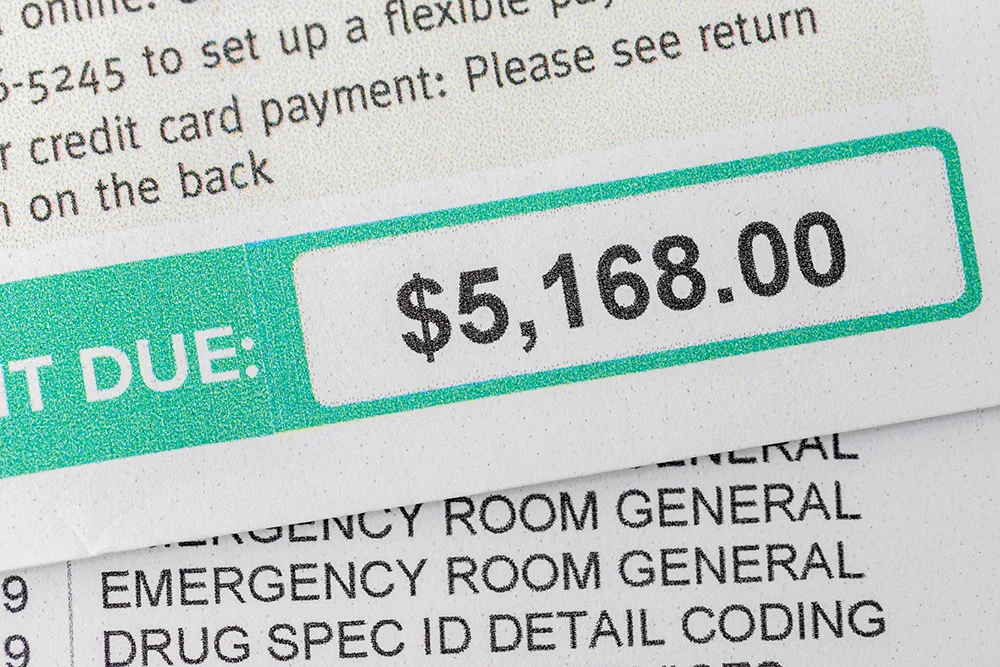

Managing patient balances has become one of the most critical financial issues for emergency rooms, urgent care facilities, freestanding ERs, and physician practice groups. In today’s healthcare landscape, more revenue is shifting directly to patients due to high deductibles, co-pays, and cost-sharing models. When balances are not collected effectively, the result is mounting write-offs that directly erode financial stability.

A 2024 report by the Medical Group Management Association (MGMA) revealed that the average practice collects only 59% of patient balances after the date of service. For high-volume emergency and urgent care providers, that gap translates into millions in lost revenue every year.

The good news is that there are proven systems and best practices for managing patient balances that can significantly reduce write-offs, improve cash flow, and preserve patient satisfaction.

Why Patient Balances Are Hard to Collect

Collecting balances in emergency and urgent care environments presents unique challenges:

- High patient responsibility – With average deductibles exceeding $2,000 for many plans, patients are often surprised by large balances they cannot pay immediately.

- Unpredictable patient flow – Unlike scheduled visits, emergency and urgent care encounters happen in stressful, high-pressure settings where financial conversations often come last.

- Incomplete insurance verification – Missed or inaccurate eligibility checks can delay payment and push more costs to patients.

- Limited upfront counseling – Financial discussions may not occur until long after treatment, when patients are less willing or able to pay.

- Delayed follow-up – Once a bill ages beyond 90 days, the likelihood of collection decreases by more than 50%.

For physician groups and facilities under pressure to remain profitable, these challenges make it essential to implement strong front-end and back-end practices to protect revenue.

Best Practices for Managing Patient Balances

1. Front-End Verification and Registration

Accurate insurance verification and eligibility checks at the point of registration are the foundation of effective revenue cycle management. Real-time systems can confirm active coverage, deductible status, and co-pay obligations before care is delivered. According to the Healthcare Financial Management Association (HFMA), automated verification reduces denials by up to 30% and prevents balances from falling through the cracks.

2. Clear Patient Communication

Patients who understand what they owe are more likely to pay. Best practices include:

- Providing written cost estimates where possible

- Offering clear, jargon-free billing statements

- Giving patients access to digital copies of their bills

- Training staff to explain balances without overwhelming patients

Clear communication builds trust while ensuring patients are prepared for their responsibility.

3. Flexible and Convenient Payment Options

Modern patients expect convenience. Offering payment plans, recurring credit card options, or text-to-pay features dramatically increases compliance. A TransUnion Healthcare study found that 74% of patients would consider switching providers if flexible payment plans were available. Facilities that adopt these tools are better positioned to collect balances without compromising patient satisfaction.

4. Timely Follow-Up and Patient Engagement

The clock is ticking once a bill is generated. Research shows that balances over 90 days old are rarely collected in full. Early and consistent engagement—such as SMS reminders, secure email links, and live follow-up calls—keeps balances top of mind and reduces write-offs.

5. Tracking and Acting on Key Metrics

Facilities that monitor performance are better able to adapt. Important KPIs include:

- Clean claim rate – percentage of claims accepted on first submission

- Days in A/R – how long it takes to collect payment

- Denial rate – frequency of denied claims and reasons behind them

By tracking these indicators, ERs, urgent care facilities, and physician groups can identify weak points in their revenue cycle and implement corrective actions before balances accumulate.

The Cost of Not Acting

Facilities that neglect best practices face serious financial and operational consequences:

- Escalating bad debt and write-offs

- Disrupted cash flow that limits staffing and growth

- Higher administrative costs from chasing old accounts

- Declining patient trust due to billing confusion and frustration

By contrast, those that implement structured patient balance management see more predictable revenue, stronger patient relationships, and greater financial stability.

FAQs

Why can’t facilities just send bills after the visit and wait for payment?

Because the likelihood of recovery drops sharply as time passes. After 90 days, most balances are written off as bad debt.

What are the most important first steps to reduce write-offs?

Real-time eligibility verification and clear communication at registration are the two most effective front-end strategies.

Do facilities and physician groups need to replace their internal billing staff?

Not always. Many organizations keep internal teams but work with specialized partners who provide additional expertise, technology, and patient engagement processes.

How does coding affect balance management?

Accurate coding is critical for correct billing. Many organizations work with third-party coders who specialize in trauma, emergency, and urgent care to ensure compliance and reduce errors.

What role does technology play in improving patient balance collections?

Modern patient engagement systems—such as SMS reminders, online payment portals, and credit card-on-file programs—help patients pay faster and more conveniently, significantly reducing write-offs.

Why Choosing the Right Partner Matters

Implementing these best practices consistently takes expertise, technology, and proven systems. For facilities and physician groups already stretched thin, working with a specialized billing partner can be the key to reducing write-offs while keeping patients satisfied.

That’s where 360 Medical Billing Solutions makes a difference. For over 25 years, we have helped emergency departments medical billing, freestanding ERs, urgent care facilities, and physician groups nationwide improve collections and protect cash flow.

Our approach includes:

- Proven strategies that reduce patient balance write-offs

- Seamless collaboration with trusted third-party coders specializing in trauma, emergency, and urgent care

- Advanced patient engagement tools that support communication and payment convenience

- Nationwide expertise delivered with little to no initial out-of-pocket costs and no hidden fees

With 360, you gain a partner who understands the unique challenges of your environment and has the systems in place to deliver measurable results.

Request a Free, No-Obligation Consultation

📩 Want ongoing insights? Subscribe to our monthly newsletter and receive 5 powerful bonus reports packed with strategies to strengthen your billing performance: https://360medicalbillingservices.com/enews/